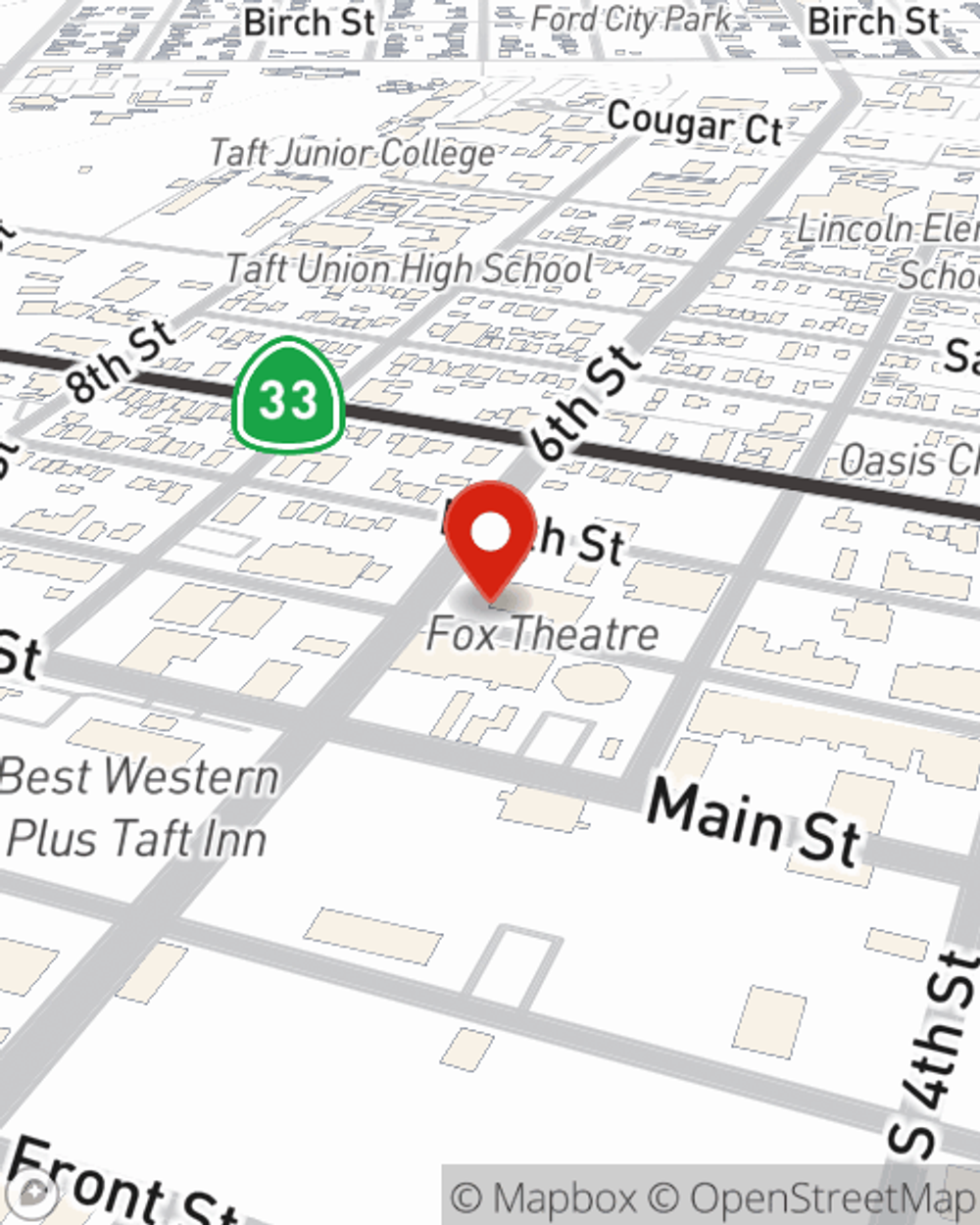

Business Insurance in and around Taft

Calling all small business owners of Taft!

Helping insure small businesses since 1935

- Taft

- Bakersfield

- Maricopa

- Tupman

- Buttonwillow

- Shafter

- Wasco

- New Cuyama

- Santa Maria

- Arroyo Grande

- Pismo

- San Luis Obispo

- Morro Bay

- Paso Robles

- Lost Hills

Coverage With State Farm Can Help Your Small Business.

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a pharmacy, an art gallery, a veterinarian, or other.

Calling all small business owners of Taft!

Helping insure small businesses since 1935

Protect Your Future With State Farm

When one is as dedicated to their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for commercial auto, worker’s compensation, business owners policies, and more.

As a small business owner as well, agent Julie Franks understands that there is a lot on your plate. Visit Julie Franks today to discover your options.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Julie Franks

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.